What's New

- Home

- /

- What's New

Merck’s Keytruda Remains a Powerhouse – Is Now the Time to Invest?

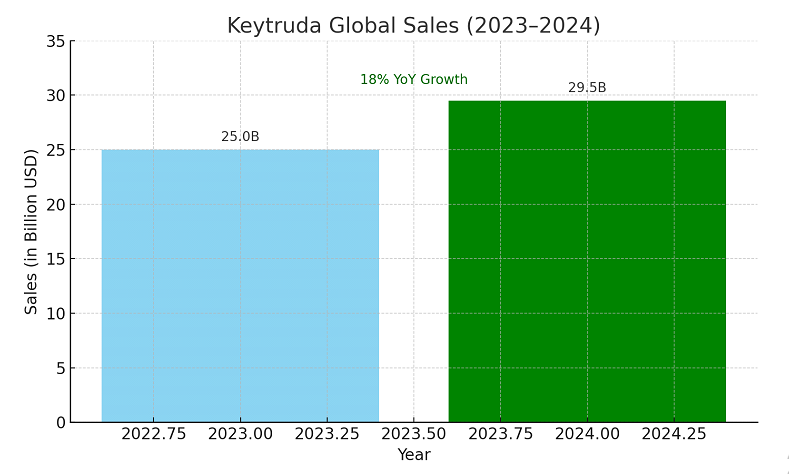

Merck & Co. (NYSE: MRK) continues to demonstrate strong financial performance, driven largely by its flagship cancer immunotherapy, Keytruda (pembrolizumab). In 2024, Keytruda generated a remarkable $29.5 billion in global sales, accounting for 46% of Merck’s total revenue and reflecting an 18% year-over-year increase.

As of May 30, 2025, Merck holds a market capitalization of approximately $192.95 billion, with its stock trading at $76.84 per share.

Despite upcoming challenges—including expected U.S. government price negotiations under the Inflation Reduction Act (potentially effective in 2028) and key patent expirations—Merck is proactively extending Keytruda’s lifecycle. A subcutaneous version is set to launch in the U.S. on October 1, 2025, aiming to boost patient convenience and market competitiveness.

Bottom Line:

With a clear strategy to defend and expand its blockbuster product and a solid track record of growth, now is a strategic time to consider investing in Merck stock as it continues to deliver long-term value and innovation in oncology.

Key Stocks & Recent News

Apple (AAPL)

• Upcoming AI push: Apple is expected to unveil new AI-driven features at WWDC this week and may announce a deeper partnership with Google. This has already lifted its pre-market stock price today.

• Valuation & analyst sentiment: Analysts see potential; Wall Street’s median target is around $235–$236, implying ~15% upside from current levels.

• Tariff risks: Ongoing trade tensions—especially tariffs affecting iPhones produced outside the U.S.—are a concern.

Tesla (TSLA)

• Robotaxi launch: Tesla is gearing up to roll out its autonomous ride-hailing service in Austin this month—a major catalyst highly anticipated in the market.

• Mixed analyst outlook: While price targets suggest a 10% downside, Tesla’s long-term prospects in AI, robotaxis, and robotics keep investor interest strong.

• Near term noise: Ongoing headlines around Musk and political entanglements may raise short-term volatility.

Offer valid until 26 January 2026 – don’t miss your Offer!

Only for Proud Indians

Offer valid until 26 January 2026 – don’t miss your Offer!

Only for Proud Indians